7 Walks (Revisiting Ernest Gambart)

Online presentation by Vermeir & Heiremans and legal philosopher Luke Mason

12th Annual Critical Finance Studies Conference

27 – 28/08/2020

Critical finance scholars are accustomed to questioning the dominant narratives that surround finance. Often, they challenge the belief that finance could be beneficial to society, if only it were regulated effectively – and if only everyone had sufficient financial knowledge. Shedding light on the limitations of current economic systems, the COVID-19 pandemic has made it all the more urgent to develop critical financial insights, drawing from a range of disciplines: from economics to sociology, accounting, arts and culture, philosophy, and politics, to name a few.

This year, the in-person 12th Annual Critical Finance Studies Conference, which was planned for Goldsmiths, University of London, had to be cancelled due to the pandemic. Instead, there was an online get-together for critical finance scholars, on the afternoons of 27th and 28th August. This event included: online keynote sessions by Gargi Bhattacharyya and Annie McClanahan, online panels, and networking sessions.

Vermeir & Heiremans and legal philosopher Luke Mason presented an audiovisual paper on their collaborative project 7 Walks. The project questions the absoluteness of property ownership. It argues that understanding property relations in a stratified way could contribute to more sustainable practices to govern natural and artistic resources.

The Belgian city of Spa offers an opportunity to connect the ecology of the arts with a natural commons: water. Four centuries of water management – from the 16th-century water export to its current financialization and monopolisation – form the basis for a reflection on property relations.

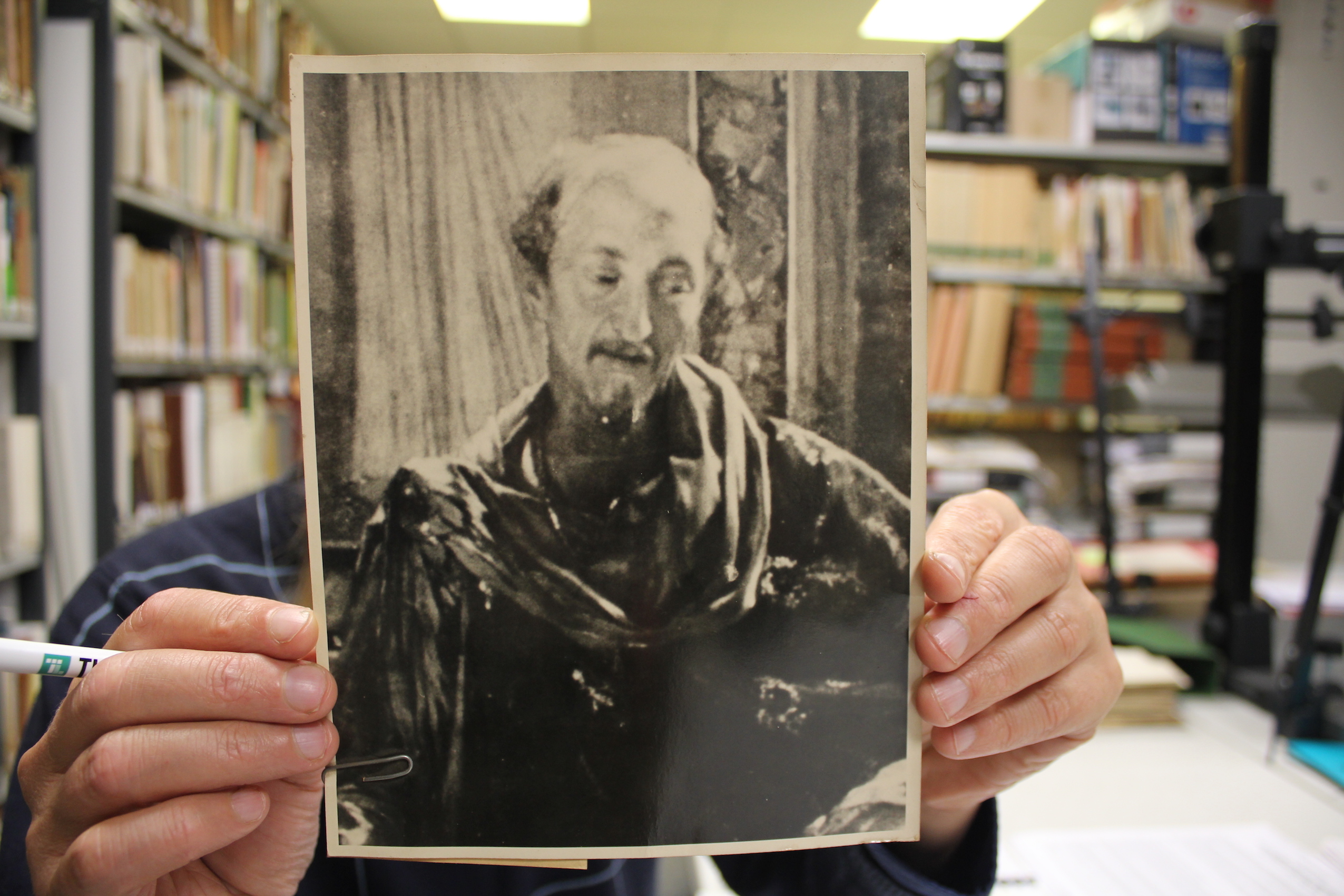

Spa towns were the setting to debate political, philosophical and artistic visions. The Belgian art dealer Ernest Gambart was a regular guest in Spa during summer when he organized parties at his Chateau d’Alsa. Gambart brought art and money close together.

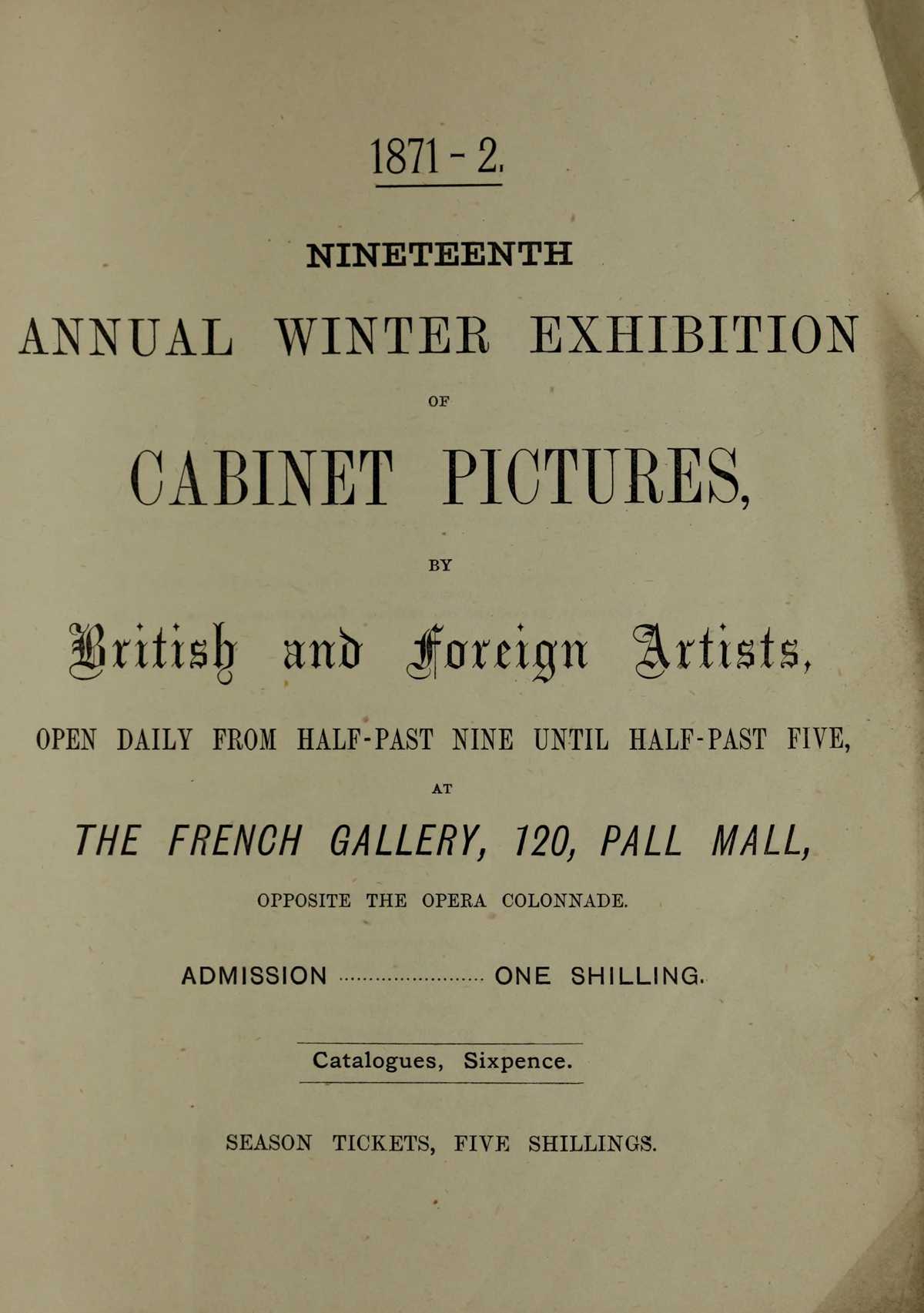

Mid-19th century Gambart dominated the London art world. His French Gallery disrupted the Academy dominated system, the authority of which rested on the claim of economic disinterestedness and ideological commitment to art as a public good. Gambart’s pioneering commercial gallery practice was able to blend discourses of public interest and private value, and create symbolic and financial value for himself as a dealer, and for the artist.

This will bring us to our concluding question: can we draw a parallel between water and art as a common good, both in terms of its ‘property relations’ and its ‘governing models’? As the COVID 19 crisis is still creating havoc in our societies (socially and economically), not in the least within the cultural sector, voices have emerged to make art and culture part of the public interest as an essential service. Like air and water, can art and culture be considered as a commons, and be governed as such?

Gambart’s pioneering commercial gallery practice and his connections with artists, buyers and critics would become a model for how modern art business would be run. Considering art and culture a commons, how would this affect the current art market, which since Gambart’s business innovations, continues to extract monetary gain on an ever larger scale, from the symbolic value of art and the ideological ‘belief’ in art as a public good?

Read more at criticalfinancestudies.org